Opening Journal Entry

Content

The opening balance is used in the beginning of a financial plan on the opening balance sheet. The length of time that a company has been operating determines what should appear on the opening balance sheet. Manage your cash flow and stay on top of your accounts with accounting & invoicing software like Debitoor. Notice that the Trial Balance keeps a running total, or trial balance, of your entries.

- If you have pending transactions for your real-life bank or credit card accounts, don’t worry.

- For entering an opening balance using a journal entry in QuickBooks Desktop, you can view Company.

- Next, set up the mapping of the file column related to the QuickBooks field.

- This amount is then carried over to the next accounting period to be used as the opening balance.

- When you create beginning balances, you must first enter the master information for each asset in the system.

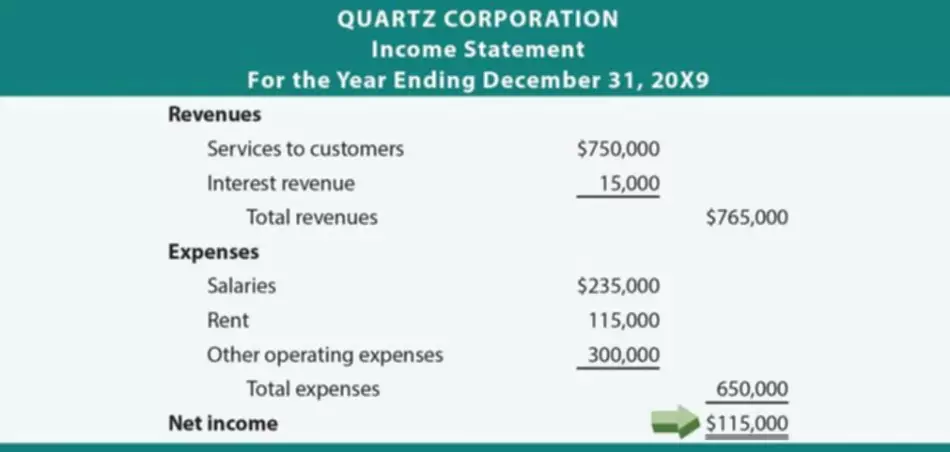

- This is also known as net profits or net earnings of a company, and as a form of equity, it can be reinvested into the company for growth purposes and is used to determine what the business is worth.

- A professional bookkeeper will help you ensure your books are up-to-date and accurate.

If the journal accounting entry amount doesn’t match your bank account statement and you close it out, then the software will adjust the opening balance equity account balance. For entering an opening balance using a journal entry in QuickBooks Desktop, you can view Company. From this menu, you need to use the Make General Journal Entries option. Afterward, you can pick one account for which this balance will get recorded. Based on the type of account you have, you can fill in the Asset, Debit, or Credit columns. Once you succeed in making the journal general entry, the balance will be added to it.

Plano based Computer/IT Training Company

This is how you will be able to record the opening balance using a journal entry in QuickBooks Online. In order to add an opening balance in QB, you can prepare a journal entry. Through this menu, you have to utilize Make General Journal Entry. Followed by setting a date, the entry needs to be assigned a number. Now, determine the account for which the entry will be made and the opening balance will be entered in QuickBooks.

As you enter your beginning balances, the total of debits and credits will display along with the balance. While entering an opening balance for Equity, Fixed Asset, other Asset, Current Asset, and Other Current Liability, be careful as it is possible that you may create a double accounting entry. In QuickBooks, both the Accounts Payable and Accounts Receivable are considered different. To ensure that all your future reconciliation is accurate, you would be required to account for all the outstanding transactions in the credit card or bank. An OBE account may cause confusion with financial statements, showing a temporary number that looks unprofessional and an unbalanced journal entry that needs to be reconciled.

Enter opening balances for accounts in QuickBooks Desktop

All those accounts which denote what the business possesses (assets) are debited and all the accounts showing amounts due by the business (liabilities) are credited. If capital (amount due by the business to the proprietor) is given, well and good, but if it is not, it can be easily found out by deducting liabilities from assets. Once all initial account balances have been entered, the balance in the opening balance equity account https://www.bookstime.com/articles/opening-entry is moved to the normal equity accounts, such as common stock and retained earnings. From this point forward, it should no longer be possible to access the opening balance equity account, which means that access to the account should be locked down. Once the account entry process is completed for all accounts, compare the total opening balance equity to the sum of all beginning equity accounts listed in the prior account balances.

- Get the most out of your Thomson Reuters Tax & Accounting products.

- In QuickBooks, you can add, enter and edit your opening balances and save a lot of time and effort at the same time.

- Using the View Register option, you can choose the journal entry and select R to mark it as reconciled.

- With the help of this software, you can import, export, as well as erase lists and transactions from the Company files.

Maintaining a record of the closing and opening balance in the financial accounts of your business is a pillar of strong accounting practises. This is one of the main aspects of managing your cash flow and keeping track of a company’s financial health. Opening balance can be recorded in QuickBooks by following several ways. This entry can be recorded in the Intuit software with the help of its Company menu. In the process of making the entry, you will be able to enter the opening balance.

How Opening Entry is Made in Journal? (With Illustration)

Opening balance is basically the amount of money in a company’s account at the beginning of a new financial period or year. This is referred to as the primary entry that’s done when an organization starts its processes or after a year-end. There are multiple steps to edit / enter the opening balance in QuickBooks. One can then ascertain how much cash one possesses or what balance there is at bank. The Cash Book on page 1.20 shows that the Indian Tobacco Co. had, on April, 30, a sum of Rs 1,150 in cash and that on the same date, the company owed to bank Rs 50,250.

A common reason for a lingering balance on your opening balance equity account includes bank reconciliation adjustments that weren’t done properly. Always make sure to account for uncleared bank checks and other factors. If you have been asking yourself, “What is opening balance equity on a balance sheet? We will go over opening balance equity, the reasons it’s created, and how to close it out so your balance sheets are presentable to banks, auditors, and potential investors. Here’s how to enter an opening balance for accounts you create in QuickBooks. In addition, opening balances are important if you transfer your accounts from one accounting system to another.

Accounting Education

When you access this website or use any of our mobile applications we may automatically collect information such as standard details and identifiers for statistics or marketing purposes. You can consent to processing for these purposes configuring your preferences below. If you prefer to opt out, you can alternatively choose to refuse consent. Please note that some information might still be retained by your browser as it’s required for the site to function. To review your file data on the preview screen, just click on «next,» which shows your file data. Next, set up the mapping of the file column related to the QuickBooks field.

- This feature allows you to share bills, payments, information, and much more.

- It is free from any human errors, works automatically, and has a brilliant user-friendly interface and a lot more.

- In other words, the closing balance of your previous accounting period will become the opening balance for the new accounting period.

- Studio Designer utilizes double-entry accounting which means that all entries must have two sides.

- It is calculated by taking the amount of money the owner of a business has invested and subtracting all liabilities and debt.

Realm will display your remaining bank balance whenever you select a checking account while entering transactions, pay invoices, and more. You will enter the amount of money your business starts with at the beginning of your reporting period (usually the 1st of each month). Your opening balance will be the closing balance of the last reporting period, ideally, zero, with all accounts balanced.

When you finish entering balances for all of your accounts, the total of the amounts in the Assets, Expenses column must equal the total of the amounts in the Liabilities, Equity, and Income column. The opening balance must be correct, otherwise your statement and report won’t produce accurate records. Once you’ve corrected the opening balance in your account, you ought to plan to reconcile your accounts together with your statement to make sure all transactions were processed correctly. It is a first amount that is carried forward at the starting of a fiscal year or the accounting period from the previous tenure. It should be treated as the very first entry in your account books. From this point you will start counting all your liabilities, expenses and assets, etc.

If you use a secondary accumulated depreciation account, you must also enter the secondary amount at this time. When you enter these amounts, the Beginning Balance Setup program automatically posts the entries to fixed assets. Finally, run the depreciation program to calculate depreciation for each month to update asset depreciation amounts to the current date.